A quitclaim deed also may not be the appropriate document if you are actually selling the property and a significant amount of money will be changing hands.įill in information about the transfer.In that situation, the other party may want a little more of a guarantee that they're getting exactly what they think they are.On the other hand, if the person to whom you're transferring the property is under the impression that you have a particular ownership interest in the property, a quitclaim deed may not be the right vehicle of transfer.For example, if there's some question as to whether you might have a claim to the property as a result of some confusion in the current owner's estate documents, but you don't want the property, you might use a quitclaim deed to negate any possible claim the probate judge decides you have in the property.You may have no interest at all, and that may match the intent of the transfer.

Keep in mind that a quitclaim deed comes with no guarantee regarding the ownership interest you may have in the property.Quitclaim deeds are most frequently used between family members or co-owners of property who are already familiar with the property itself as well as with each other. Any questions regarding the transfer of property taxes and future tax liability should be directed to an accountant or tax professional.Ĭonfirm you're using the right kind of deed.If you're unsure about the tax status of the property, you can check the county recorder or tax assessor's records for the property, or look on the most recent property tax statement.

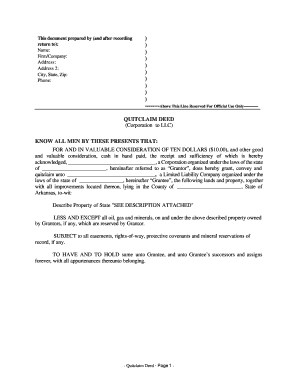

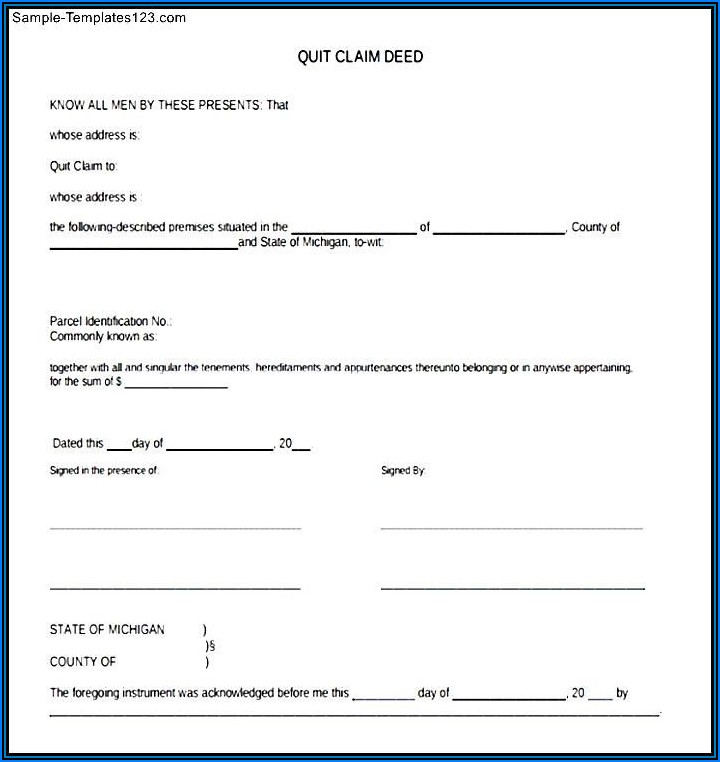

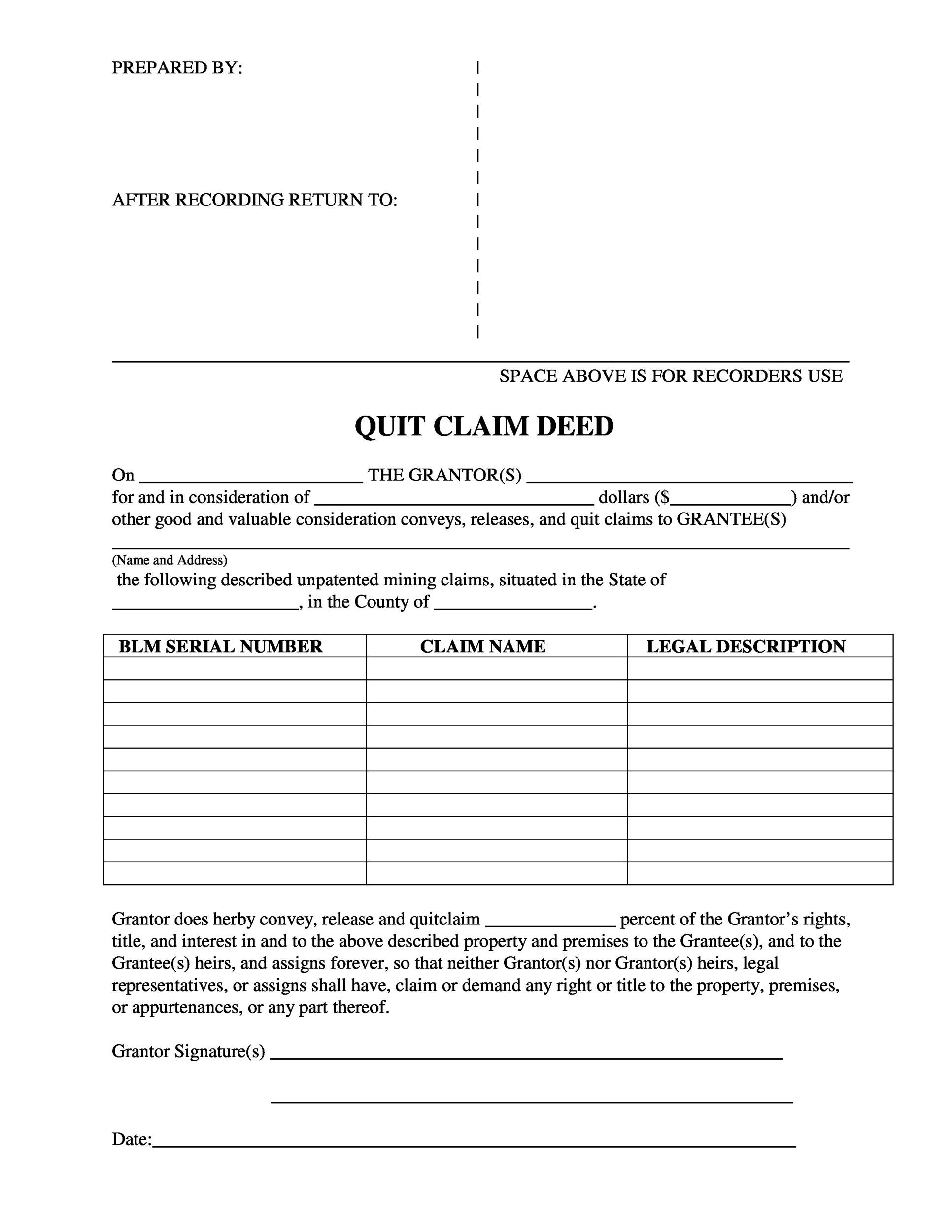

EXAMPLE OF A QUIT CLAIM DEED COMPLETED FULL

However, if you paid the property taxes on the property, you'll have to make sure the taxes are paid in full up to the date of the transfer, and that the tax liability is transferred appropriately.If that is the case, tax statements typically will continue to be sent to the person to whom they've been sent in the past.Transferring your interest in the property may have nothing to do with property taxes, particularly if someone else was already paying the property taxes on the property.Transferring property doesn't necessarily transfer the tax obligation, and in most states the property taxes must be up to date if you want to transfer any interest in the property.

0 kommentar(er)

0 kommentar(er)